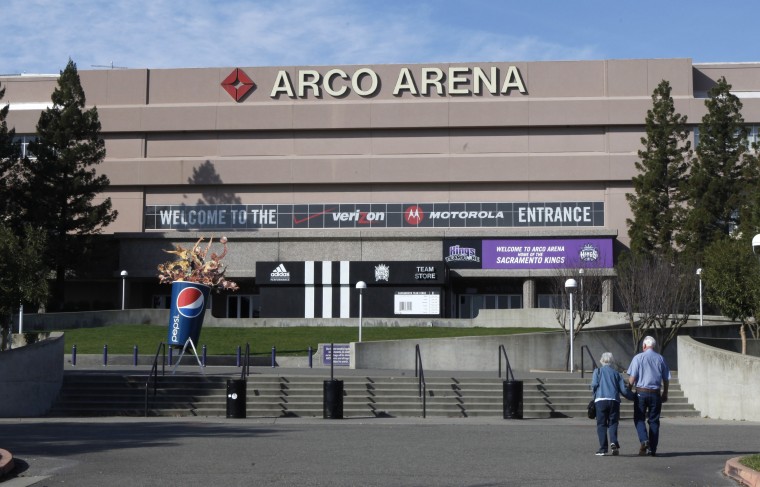

In 1988, I was working in San Francisco, desperate to escape the drudgery of proposals and spreadsheets that define an apprenticeship in investment banking. Like a struggling actor waiting tables, I was looking for that one break, that one deal, to launch my career. That deal was the Arco Arena.

In 1988, I was working in San Francisco, desperate to escape the drudgery of proposals and spreadsheets that define an apprenticeship in investment banking. Like a struggling actor waiting tables, I was looking for that one break, that one deal, to launch my career. That deal was the Arco Arena.

Once upon a time, sports stadiums and arenas were municipal projects, underwritten by the taxing authority of the resident city or county. No commercial lender would approve a project entirely dependent on event-driven revenue like ticket sales and popcorn purchases. These projects required the deep pockets of the local community. The economics of all that changed with the advent of luxury skyboxes.

Team owners discovered that creditworthy corporations were willing to sign rather expensive long-term leases to watch an event in a private, luxurious setting, with real food and their own bathroom. Build enough of these skyboxes, and the aggregate lease revenue alone was enough to pay the debt service on a larger, modern facility. The team owners could build and own the facility, and keep that new source of revenue, rather than plead with the local community for a new venue. More importantly (from a banker?s perspective), the financing was no longer dependent on unreliable, event-driven revenue, but rather the stable income from credit-worthy lessees.

The financing was packaged and marketed to emphasize the skybox revenue as the foundation of the debt security. The Fuji Bank, then a AAA-rated commercial bank, came aboard to credit-enhance a five-year taxable bond, which priced at 10% (a terrific interest rate at the time).

Perhaps a new concept is the notion of packaging and marketing a financing by differentiating, and segregating, assets and income streams. In its most basic form, it is fundamentally no different than a real estate owner who seeks financing by emphasizing his anchor tenant. If a financing is straightforward, easily understood, and if you have a smart banker, the packaging may not matter. However, every lender?s reaction to a financing with an unfamiliar structure, collateral or revenue stream; which might (for any reason) elicit the perception of heightened risk, is to require an additional cushion of safety: more collateral, more control, and a higher interest rate, if indeed they remain interested at all. Even for the most creditworthy projects, it is customary for a lender (unconstrained by competition or negotiation by an experienced client) to place a blanket lien on all revenue and every asset, and even require additional recourse to third-party guarantors. This obviously protects the lender?s interest, but at the direct expense of the borrower; as it limits the organization?s ability to secure future financings, at least not without replacing the original lender at potentially considerable expense. A skillfully packaged financing has one agenda: clearly illustrating mitigated risk to potential lenders, in such a way as require the encumberance of the fewest possible assets and revenue streams.

Skyboxes changed the math, and changed the game, launching a sports stadium and arena construction boom that lasted for decades. The Arco Arena financing gained some notoriety and received mention in The Wall Street Journal. Concurrently, the Palace of Auburn Hills (home of the Detroit Pistons) financing, achieved through the same skybox revenue emphasis, was completed in that same year. The concept took off. I subsequently spent several years traveling and meeting team owners throughout the country. I am not a spectator sports fan. In fact, I find professional sports to be unbearably boring. When the owners invited me to watch an event from the owners box, I would decline, on the premise that I had to maintain my objectivity. And I was complimented on my professionalism.

Alas, the purely private concept did not endure. Team owners quickly realized that it never pays to let a patsy off the hook, and almost immediately used the skybox revenue and the new form of financing as leverage against the vanity of local politicians to demand greater public funding, in the form of public/private partnerships, to construct ever grander facilities. Al Davis was the emperor of the technique, bluffing four California cities into offering the Raiders extraordinary compensation packages without taking a penny of risk himself. Soon, it became very difficult to get momentum on any project, as every team owners? vanity was suddenly at stake to become the next master of the universe. Every Wall Street firm poured into the new sports facility financing business, and every completed deal spawned a dozen new consultants who were now facilities experts.

The early deals, absurdly lopsided on behalf of the sports teams, could arguably be excused as a learning exercise for municipalities who were bolstered by an academic rationalization that such public projects were an essential catalyst for economic redevelopment. The City of Oakland and Alameda County, for example, ultimately spent hundreds of millions of dollars to attract and retain the Raiders, tax dollars that otherwise could not be spent for other local public services. Of course, in most cases, the redevelopment catalyst was illusory. There were no consequences to the careers of the political sponsors and advocates who squandered public funds. It was apparently not even a learning experience. Currently, Sacramento struggles with a new ownership group threatening to move the Kings (article here), while the Minnesota Vikings are demanding a new one billion dollar facility.