Let us preface this discussion with the following graphs.

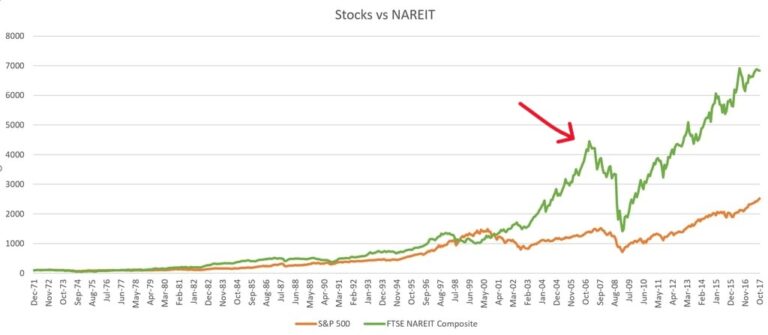

The first graph is one I will refer to repeatedly in this series. It compares commercial real estate with the S&P 500 over the past fifty years. The red arrow highlights 2006, in which real estate was considered to be one of the biggest speculative bubbles in history. As you can see, we have blown right through those price levels. And note that the graph ends in 2017. Prices have only become more extreme in the past five years.

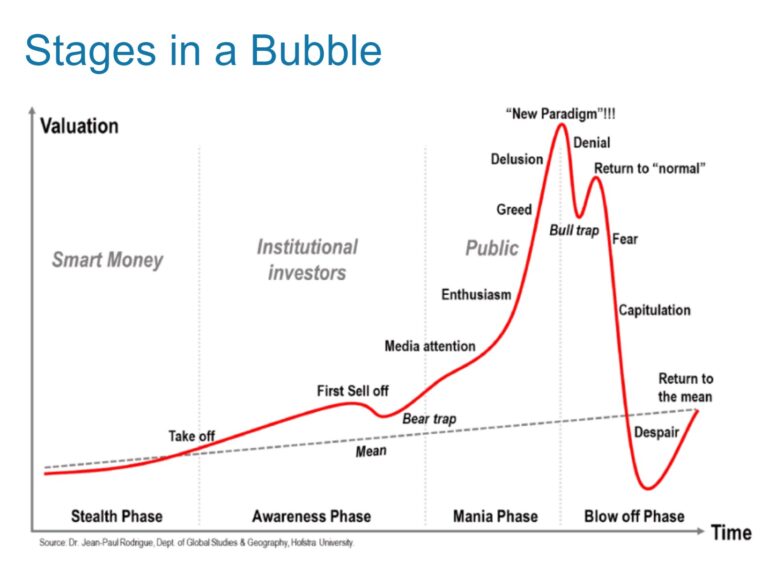

The second graph illustrates the typical stages of a speculative bubble. At the very peak of every bubble, there emerges a new Paradigm, a compelling rationalization why asset prices are not only appropriate, but must continue to rise.

Commercial real estate sales continue to be on fire. Quality properties are “priced for perfection,” for which everything must go very right, for a very long time, to justify such enthusiasm. And yet tens of billions of dollars (in institutional and retail money) continue to flow into real estate, in spite of rising interest rates and a forty-year high in new construction, across almost every sector.

Why such tremendous optimism? What is the New Paradigm for real estate? Inflation. Conventional wisdom dictates that real estate is the best hedge against inflation, and therefore must continue to rise.

Certainly, we are experiencing price inflation, from the gas pump to the grocery store. Arguably, price inflation alone should be a negative for real estate. Higher expenses increase the cost of owning real estate, and leave less income for higher rent and bigger mortgages from prospective tenants and buyers. Ironically, the argument for all the new apartment and build-to-lease housing construction is that the average family can no longer afford to buy a house, but will nonetheless be able to afford ever escalating rental payments (the alternative, that supply and demand will eventually prevail, and housing prices will fall, is apparently unthinkable).

Wage inflation therefore is the key to the New Paradigm. Theory suggests (and only suggests) that wage inflation is correlated with price inflation. And for this model to work, wage inflation must outpace price inflation, for NOI to increase and for properties to appreciate.

Certainly, the job market has been tight over the past two years or so. And in some locations, minimum wages have increased. Historically, wage inflation was more closely correlated with price increases (in the 1970’s and 1980’s, it was a leading indicator). As such, it has been argued that wage inflation may be currently lagging far behind price inflation, but once it catches up, forecasted rent and lease increases will materialize.

However, many companies have recently announced layoffs (including recession-resistant tech companies) at the hint of a recession, and over 50% of all CEOs polled say they are considering cutting jobs in the next six months, and remote workers may be the first to go (which may not bode well for Zoom towns).

A fascinating statistic: A higher percentage of prime-aged American men don’t work now—again, at a time of historically low “unemployment”—than during the Great Depression. These are men who choose not to work and have dropped out of the labor force. This represents a significant labor overhang. If the U.S. enters a recession and these men are forced to return to work, the labor supply and demand balance will not favor employee leverage for higher wages.

Wage stagnation, a more realistic scenario, certainly does not argue for greater rental income potential. Inflationary cost pressure, rising interest rates and borrowing cost, pending supply of new projects – are all tremendous headwinds for a renewed bull market. Indeed, it would seem like a perfect storm for a real estate secular bear market.